All Categories

Featured

There is no one-size-fits-all when it revives insurance coverage. Getting your life insurance coverage plan best thinks about a variety of aspects. [video description: Pleasant music plays as Mark Zagurski speaks to the camera.] In your active life, economic independence can feel like a difficult goal. And retired life might not be top of mind, due to the fact that it appears so much away.

Pension plan, social protection, and whatever they would certainly taken care of to conserve. It's not that simple today. Fewer employers are providing traditional pension and many business have lowered or stopped their retired life strategies and your capacity to rely exclusively on social safety and security remains in concern. Also if benefits have not been reduced by the time you retire, social security alone was never ever planned to be adequate to spend for the way of living you want and are entitled to.

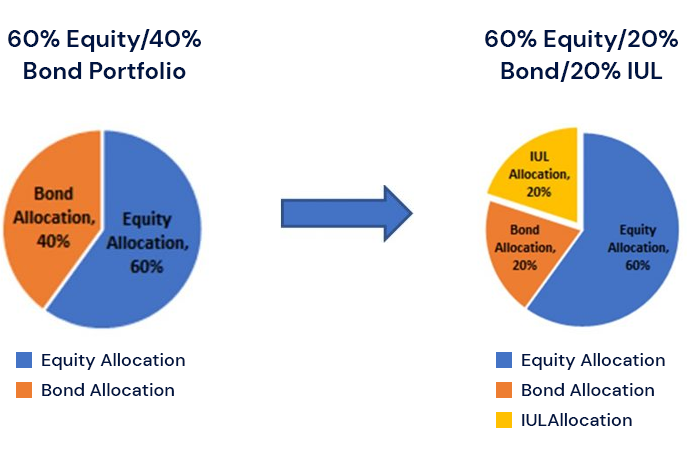

/ wp-end-tag > As component of an audio monetary approach, an indexed universal life insurance plan can assist

you take on whatever the future brings. Prior to committing to indexed universal life insurance, here are some pros and disadvantages to think about. If you select a good indexed universal life insurance policy plan, you may see your money value expand in value.

Iul Unleashed

Because indexed global life insurance coverage needs a certain degree of threat, insurance policy firms often tend to maintain 6. This type of strategy additionally uses.

Usually, the insurance coverage company has a vested rate of interest in doing better than the index11. These are all aspects to be considered when picking the best type of life insurance for you.

National Life Group Indexed Universal Life

However, given that this type of policy is much more complicated and has a financial investment element, it can typically feature higher costs than various other plans like entire life or term life insurance policy. If you don't think indexed universal life insurance policy is ideal for you, right here are some choices to think about: Term life insurance coverage is a short-term policy that commonly supplies coverage for 10 to three decades.

Indexed universal life insurance is a kind of policy that offers much more control and versatility, together with higher cash money value growth capacity. While we do not offer indexed global life insurance policy, we can offer you with even more details about whole and term life insurance policy plans. We recommend exploring all your alternatives and chatting with an Aflac agent to discover the most effective fit for you and your family members.

The rest is contributed to the cash worth of the policy after charges are deducted. The money value is attributed on a regular monthly or annual basis with interest based on boosts in an equity index. While IUL insurance might show useful to some, it is necessary to comprehend exactly how it works prior to acquiring a policy.

Latest Posts

指数 型 保险

Best Variable Life Insurance

Universal Life Crediting Rate